Determine cap rate

The cap rate of a property is determined based on the potential revenue and the risk level as compared to other properties. For example is the income in the pro-forma skewed favorably for the seller.

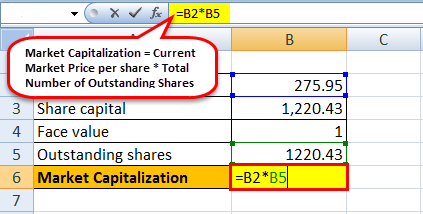

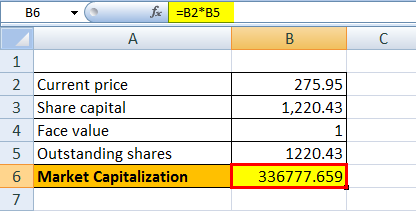

Market Capitalization Formula How To Calculate Market Cap

My application take away ends up being when Im analyzing a property I need to determine why a cap rate is high.

. The cap rate value will be automatically calculated for you. As a general rule the formula will determine a higher cap rate for properties that have a higher net operating income and lower valuation. Capitalization rate may be based on the current property value instead of the purchase price.

Determine household size. The cap rate is calculated by finding the ratio of the net operating income to the current market value of the property. Cap rate is a metric that investors use to determine the expected rate of return based on the expected annual income of a property.

Find in-depth news and hands-on reviews of the latest video games video consoles and accessories. To determine the market cap rate you can do three different things. Valuation Offer Price Net Operating Income Desired Cap Rate.

Ask commercial brokers familiar with the neighborhood the apartment complex is located. Cap Rate Example Calculation. The relationships between rents operating costs and acquisition costs are intertwined.

With the cap rate as a tool in your rental property toolbox youll be able to more confidently buy and profit from your own investment properties. On the flip side of the coin properties with a lower net operating income and. Cap Rate Net Operating Income NOI Property Value.

The most important thing to remember is that you. Read more is very simple. This can be helpful if you are looking at purchasing different tracts of.

Annual Cash Flow Net Operating Income - Total Debt Service. Helpfully MoneySavingExpert has collated data based on standard appliances and worked out the cost using the upcoming 1 October 2022 price cap charges for electricity 5189pkWh. Leave a Comment Cancel Reply.

Cap rate is both a measure that tells you how much you. Capitalization rate or Cap Rate for short is commonly used in real estate and refers to the rate of return on a property based on the net operating income NOI that the property generates. If you can get the NOI and sales price you divide the NOI by the.

First cap rate is a quick and easy method you can use to determine if a property is immediately profitable by comparing the income you will be generating against the purchase price. 2050 is less than the 2871 allowed for a 4-person household so determine net. But measuring the cap rate does not tell an investor all.

A property with an asking price of 1m and NOI. Research similar recently sold properties in the area. It helps investors determine if a property to be purchased is a good deal or it is overpriced.

For example if a 1 million investment property is generating 50000 in annual net operating income rental fees less operating expenses the cap rate on the investment is 50. EX net rental income is 18k and total cash cost is 300k. This will determine the return on investment ROI.

Other methods used to determine the rate of return on a rental property are mainly the cap rate and the cash on cash. Talk with at least three different brokers and find a consensus. A commonly used valuation method combines income and the capitalization rate to determine the current value of a property being considered for purchase.

Comparing different cap rates in the neighborhood where you would like to invest is an excellent way to determine which properties. 15 February 2022. What is Capitalization Rate Cap Rate.

Cap Rate 8. In this example the rate of return on your investment is. What is Cap Rate Formula.

Total Debt Service Principal Payment Interest Payment. In addition to a propertys market value one of the first things youll want to do as a real estate investor whos considering buying a purchase is determine is its operating income and costs. Essentially a lower cap rate implies lower risk while a higher cap rate implies higher risk.

It is calculated by dividing the net operating income by the assets current market value and percentage. 4 people with no elderly or disabled members. A propertys capitalization rate or cap rate is a snapshot in time of a commercial real estate assets return¹ The cap rate is determined by taking the propertys net operating income the gross income less expenses and dividing it by the value of the asset² Commercial real estate is an investment type so the return is a reflection of the risk and the quality of the.

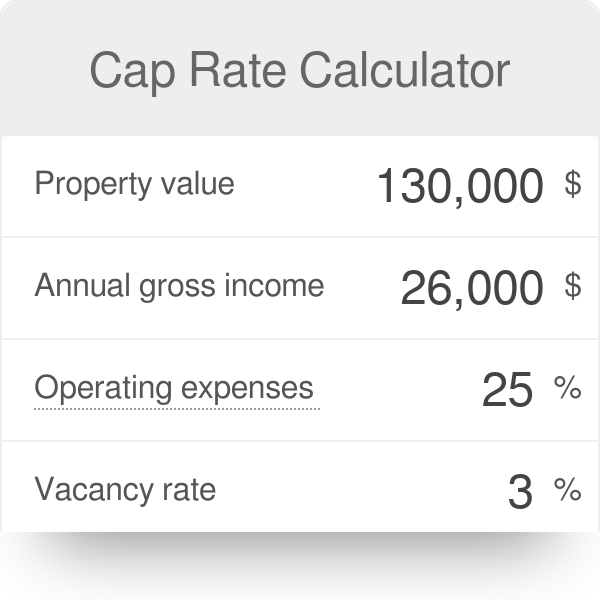

The cap rate calculator alternatively called the capitalization rate calculator is a tool for everyone interested in real estateAs the name suggests it calculates the cap rate based on the value of the real estate property and the income from renting itYou can use it to decide whether a propertys price is justified or determine the selling price of a property you own. To determine a safe cap rate you must identify how much risk you are comfortable exposing yourself to. A cap rate is calculated by dividing the Net Operating Income NOI of a property by the purchase price for new purchases or the value for refinances.

Keep in mind that this is the simple rate of return on investment formula and as you can tell it is very general and includes a lot of estimates and unproven numbers. Capitalization Rate Net Operating Income Purchase Price. Rakshit Bisht March 4 2021 - 811 am.

Cap Rate in Real Estate Formula. Add gross monthly income. Last month Ofgem the UKs energy regulator announced it is raising its cap on standard variable rate default tariffs by 12 to 1277 its highest-ever level.

The formula for Cap rate or Capitalization rate Capitalization Rate Capitalization Rate is the rate that helps determining value of a real estate investment. It projects the expected rate of return on the investment made. To determine Cap Rate combine Net Operating Income and appreciation.

Capitalization rate or cap rate is a real estate valuation measure used to compare different real estate investmentsAlthough there are many variations the cap rate is generally calculated as the ratio between the annual rental income produced by a real estate asset to its current market valueMost variations depended on the definition of the annual rental income and whether it is. If gross monthly income is less than the limit for household size determine net income. Use the calculator below to calculate your cap rate.

Investors hoping for a safer option would therefore favor properties with lower cap rates. If a property costs more it will need to fetch a higher rent to achieve a cap rate associated with cheaper properties in the same neighborhood. Appreciation in your community is 2 per year.

In other words capitalization rate is a return metric that is used to determine the potential return on investment or payback of capital. The new cap takes effect from 1. Simply enter your NOI and purchase price or market value.

Added information on what to do if someone has a negative follow-up PCR test after a. But while the average cap rate spread for those markets was between 100 and 200 basis points higher for the first part of the past decade it has narrowed to less than 100 basis points for all. 1500 earned income 550 social security 2050 gross income.

Second cap rate allows you to compare investment properties at their current state.

Cap Rate Calculator Free Online Calculation Free Online Capitalization Rate Calculator

Cap Rate Calculator

Discount Rate Formula And Cost Of Capital Calculator Excel Template

Forget Everything You Ve Heard About What Is A Good Cap Rate Investment Property In 2022 Real Estate Investing Real Estate Investing Rental Property Real Estate Tips

Market Capitalization Formula How To Calculate Market Cap

Market Capitalization Formula How To Calculate Market Cap

Understanding Cap Rates The Answer Is Nine Capitalization Rate Exam Answer Understanding

When You Know The Net Operating Income Of A Property And Divide It By The Cap Rate For Similar Properties Capitalization Rate Property Valuation Capitalization

Investing Rental Property Calculator Mls Mortgage Real Estate Investing Rental Property Rental Property Management Real Estate Rentals

What Is Cap Rate And How To Calculate It Infographic What Is Cap Real Estate Infographic Buying Investment Property

Cap Rate Calculator Factory Sale 51 Off Cocula Gob Mx

How To Figure Cap Rate 6 Steps With Pictures Wikihow Real Estate Investing Rental Property Rental Property Investment Real Estate Education

Pin On Financial Ideas

Easy Visual For Calculating Cap Rate Investing In A Rental Pre Construction Not All Projects Are The Same R Being A Landlord Investing Real Estate Investor

Cap Rate Calculator

Calculating Cap Rate Clearance 52 Off Www Ingeniovirtual Com

Burn Rate Formula And Calculator Excel Template